Tutorial - How to use candlestick pattern in forex trading. (Part 2)

Posted by

nimzoindy

Labels:

Forex

Falling Three Methods

A bearish continuation pattern. A long black body is followed by three small body days, each fully contained within the range of the high and low of the first day. The fifth day closes at a new low.

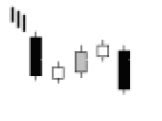

Rising Three Methods

Rising Three MethodsA bullish continuation pattern. A long white body is followed by three small body days, each fully contained within the range of the high and low of the first day. The fifth day closes at a new high.

Doji

DojiDoji are important candlesticks that provide information on their own and also feature in a number of important patterns.Doji form when a security's open and close are virtually equal. The length of the upper and lower shadows can vary and the resulting candlestick looks like a cross, inverted cross or plus sign. Alone, doji are neutral patterns. Any bullish or bearish bias is based on preceding price action and future confirmation. The word "Doji" refers to both the singular and plural form.

Dragon fly doji

Dragon fly doji form when the open, high and close are equal and the low creates a long lower shadow. The resulting candlestick looks like a "T" with a long lower shadow and no upper shadow.

Dragon fly doji indicate that sellers dominated trading and drove prices lower during the session. By the end of the session, buyers resurfaced andpushed prices back to the opening level and the session high.

The reversal implications of a dragon fly doji depend on previous price action and future confirmation. The long lower shadow provides evidence of buying pressure, but the low indicates that plenty of sellers still loom. After a long downtrend, long black candlestickor at support, a dragon fly doji could signal a potential bullish reversal or bottom. After a long uptrend, long white candlestick or at resistance, the long lower shadow could foreshadow a potential bearish reversal or top. Bearish or bullish confirmation is required for both situations.

Gravestone doji

Gravestone doji form when the open, low and close are equal and the high creates a long upper shadow. The resulting candlestick looks like an upside down "T" with a long upper shadow and no lower shadow.

The reversal implications of a dragon fly doji depend on previous price action and future confirmation. The long lower shadow provides evidence of buying pressure, but the low indicates that plenty of sellers still loom. After a long downtrend, long black candlestickor at support, a dragon fly doji could signal a potential bullish reversal or bottom. After a long uptrend, long white candlestick or at resistance, the long lower shadow could foreshadow a potential bearish reversal or top. Bearish or bullish confirmation is required for both situations.

Gravestone doji

Gravestone doji form when the open, low and close are equal and the high creates a long upper shadow. The resulting candlestick looks like an upside down "T" with a long upper shadow and no lower shadow.

Gravestone doji indicate that buyers dominated trading and drove prices higher during the session. However, by the end of the session, sellers resurfaced and pushed prices back to the opening level and the session low.

As with the dragon fly doji and other candlesticks, the reversal implications of gravestone doji depend on previous price action and future confirmation. Even though the long upper shadow indicates a failed rally, the intraday high provides evidence of some buying pressure. After a long downtrend, long black candlestick or at support, focus turns to the evidence of buying pressure and a potential bullish reversal. After a long uptrend, long white candlestick or at resistance, focus turns to the failed rally and a potential bearish reversal. Bearish or bullish confirmation is required for both situations.

Long-legged doji

This line often signifies a turning point. It occurs when the open and close are the same, and the range between the high and low is relatively large.

As with the dragon fly doji and other candlesticks, the reversal implications of gravestone doji depend on previous price action and future confirmation. Even though the long upper shadow indicates a failed rally, the intraday high provides evidence of some buying pressure. After a long downtrend, long black candlestick or at support, focus turns to the evidence of buying pressure and a potential bullish reversal. After a long uptrend, long white candlestick or at resistance, focus turns to the failed rally and a potential bearish reversal. Bearish or bullish confirmation is required for both situations.

Long-legged doji

This line often signifies a turning point. It occurs when the open and close are the same, and the range between the high and low is relatively large.

Tutorial Part 1

Tutorial Part 1

Subscribe to:

Post Comments (Atom)

Post a Comment